Home Buyers-The Waiting Game is a Losing Game

By JASON HILAND

Right now, you are trying your best to make the right financial decisions for you and your family. You’re carrying a ton of weight on your shoulders, and it doesn’t seem to be getting any lighter. You are confident in yourself but not the world around you. There’s a good reason for that. The world has been throwing you curveballs over and over for what seems like 20 years. You know what? You’ve survived every single one of them. Each may not have ended with a home run, but you have yet to strike out. Be proud of that fact…very proud! Now, here the world comes again. Interest rates are rising, rents and home prices are rising, and even baby food is hard to find. Lions, tigers, and bears, oh my!

You are your own hero. Heroes take action and only you can do that. However, name one hero that didn’t have a trusted guide. I bet you can’t find one. Well, if you do not have that guide in your life when it comes to real estate, I‘ll throw my hat into the ring. I am in the position to have the educational resources and dedicated time to help you understand the environment we find ourselves in.

Ok, so let’s get real honest right from the get-go. Which one of these people are you?

- The bubble is about to burst just like 2008!

- Home prices are going to fall and that is when I’m going to buy a home!

- Rates are too high to buy. I’ll wait until they fall back down soon!

- Renting is a better financial decision right now!

Whether you are renting or in a home that doesn’t fit your family’s current lifestyle, I am guessing you have found yourself saying one of these lines around the water cooler. I get it. Shifts in the market are scary. However, fear is an emotion and emotions usually do not make the best business partners.

“Fear is the path to the Dark Side. Fear leads to anger, anger leads to hate, hate leads to suffering”

-Yoda

So, now that we have all just re-learned a valuable lesson about fear from the greatest Jedi Knight to ever exist, let’s address each one of these emotional statements one-by-one.

The Bubble is about to burst just like 2008!

Let’s face it, 2008, and the Great Recession that followed, was nothing less than craptastic. Make no mistake, we have not seen the last economic crisis of our lives. It may be tomorrow. It may be 20 years from now. However, if it is tomorrow, it will not be for the same reasons as 2008.

One of the biggest reasons for the Great Recession was the fact that lenders, backed by the mortgage-backed securities, treated mortgages like they were Snicker’s bars on Halloween. They allowed consumers, with little to no credit, to borrow well above their means. Loan-to-Value was thrown out the window and some were borrowing at 100%+. Not to mention all of the 3- and 5-year adjustable rate mortgages that crushed investors’ souls when they got caught holding the bag. Adding to that shitstorm, U.S. homebuilders were producing almost 3 million homes per year providing an enormous surplus in the housing supply. From 2011 to 2022, home builders scaled back (licking their wounds) to a total of about 6 million homes. That has caused a major deficit in supply that is more capable of supporting current home values.

Additionally, U.S. consumers (thanks in part to the VID) have done a much better job of managing debt. In 2006, U.S. consumer debt was almost equal to that of our national GDP. That left very little, if any room, for a downturn. According to the Federal Reserve, today our aggregate debt sits at about 75% of our GDP. Meaning? We are holding enough liquidity and equity to brave a storm.

I do not have a crystal ball, but I do my research. This is not 2008. Let’s put that excuse in our pocket!

Home prices are going to fall and that is when I’m going to buy!

They may fall. Let’s get that out there. Though, many will say they will continue to rise but at a much slower pace. As mentioned above, we have an inventory shortage. Now, I have a degree in economics, but I do not call myself an economist. I do understand a bit about supply and demand curves. This lack of supply, unlike the wild wild west of 2008, should help sustain prices in the near future.

Additionally, why would you want to buy when prices start falling? Unless you’re the Nostradamus of our time, you have no idea when we will hit the bottom. The peak and the pit are lagging indicators so we don’t actually know they’ve happened till they’re behind us. Therefore, there is a better than average chance that you are going to buy AS prices slide. Congrats, you just spent $600,000 on a house, moved your family in, and lost $10,000 in equity before your first mortgage payment.

Rates are too high to buy. I’ll wait until they fall back down soon!

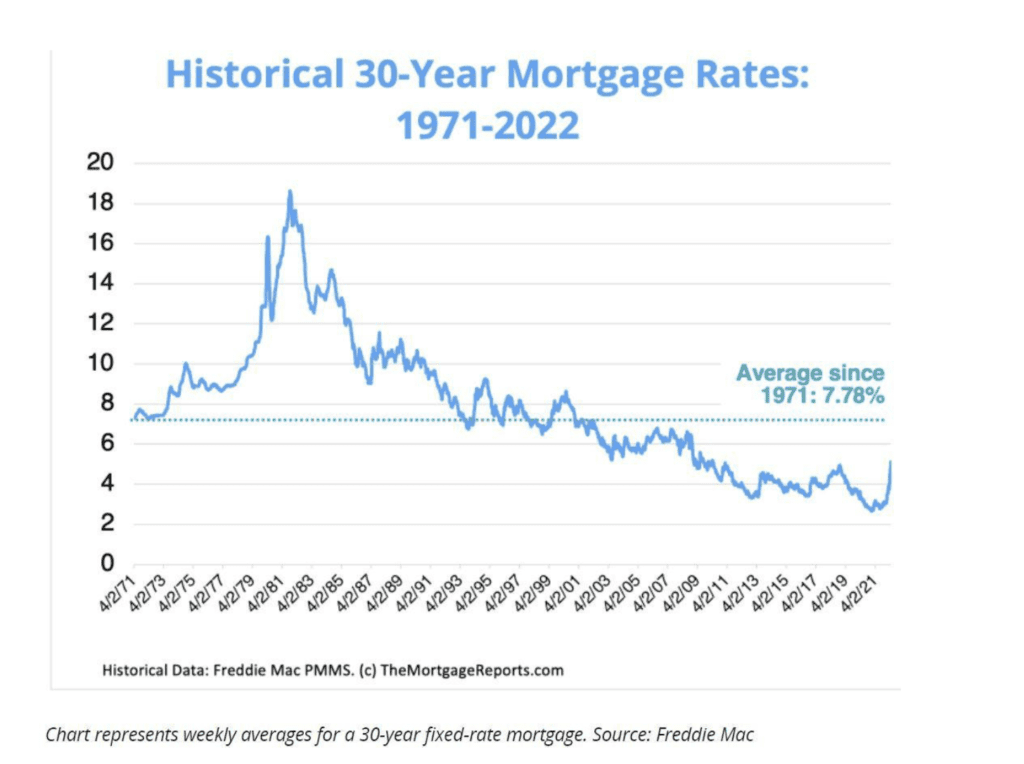

Oh, 3%, how we miss you already. We can’t wait to see you again! I hope that candle in the window has an extremely long wick. Freddie Mac started tracking mortgage rates back in 1971 (51 years). You can see the chart below. Look how often we have seen 3%-4% mortgage rates. Look harder. Do you see it? That’s what I thought. Only the last 5-6 years.

Most of you either got crushed on your first home in the Great Recession, bought after, or are looking to buy your first. During these years, the Fed has been doing everything in their power to keep our heads above water through a financial crisis and a global pandemic. That has involved many actions, but the most noteworthy is keeping interest rates low. I believe you will agree that these have not been “normal” times, but these low rates are all you know. Normal times, or let’s call them average times, see interest rates around 8%. You know that family home your dad bought back in the early 80’s? Yep, 16%! So, speculating on when interest rates will fall again may keep you renting or in that home that doesn’t fit your needs much longer than you expect. If you are waiting to buy when life gets back to “normal”…normal may look much different than you think!

Also, let’s not forget, your interest rate today is not your forever-rate. If you really believe that rates are going to drop relatively soon, then you can always refinance at that lower rate. That way you do not lose out on the appreciation of equity and the tax benefits of home ownership while you wait for the rate-pocalypse. Then, if rates continue to go up, you can brag to all your friends and family how you were insightful enough to lock-in 5%. Sounds to me like a no-lose situation!

Renting is a better financial decision right now!

Stop! You stop it right now! This is almost never the case. Owning a home is the single largest, long-term contributor to your wealth. In 2021, the average home appreciated 17%. That means, if you bought a $400,000 home at the beginning of the year, that home alone increased your personal wealth by $68,000 by the start of 2022. Now, I know 2021 was an extreme year for appreciation, but if you were renting you only saw your wealth decrease. At least you get to write your rent payments off on your taxes…oh, wait! Well, at least you got to borrow against the equity in your apartment to make another investment…crap!

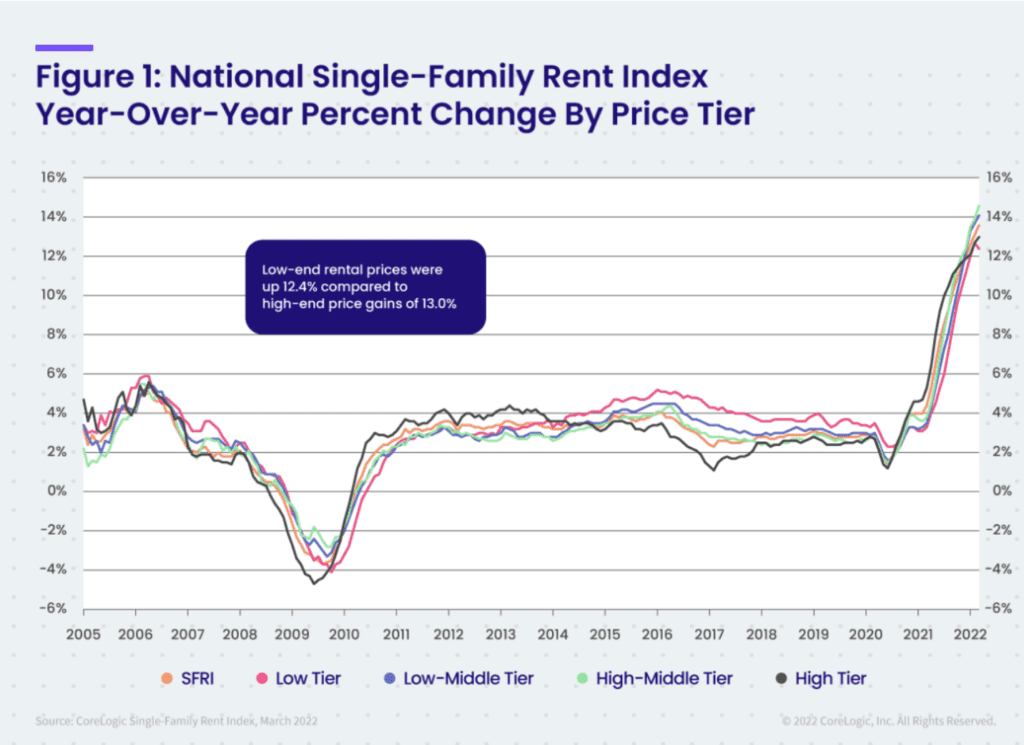

I think we all agree that there is a housing shortage due to the fallout for builders after the Great Recession. When there is a shortage, that causes prices to increase. Very simple economics. Now, add to that fact that many landlords are now adjusting rents to recover from the pandemic. The chart below from CoreLogic, a leading global property analytics provider, gives you a quick idea of what has happened to rental costs. If you think housing prices and interest rates are difficult to swallow even with all the financial benefits of equity and tax benefits, chew on this.

Renting is the blackhole where wealth goes to die.

So, at the beginning of this I asked you to point at which person you were. Did you find yourself? I did that because I have heard my friends and family state each one of these reasons/excuses. Actually, I have heard each one more than once. This market has been difficult to get a handle on for even the most experienced investor. However, if you ask a successful investor in any type of market they will tell you the most important investment rule of all: Building wealth is not about TIMING the market. Building wealth is about being IN the market.

Go build your wealth!

Be the hero!