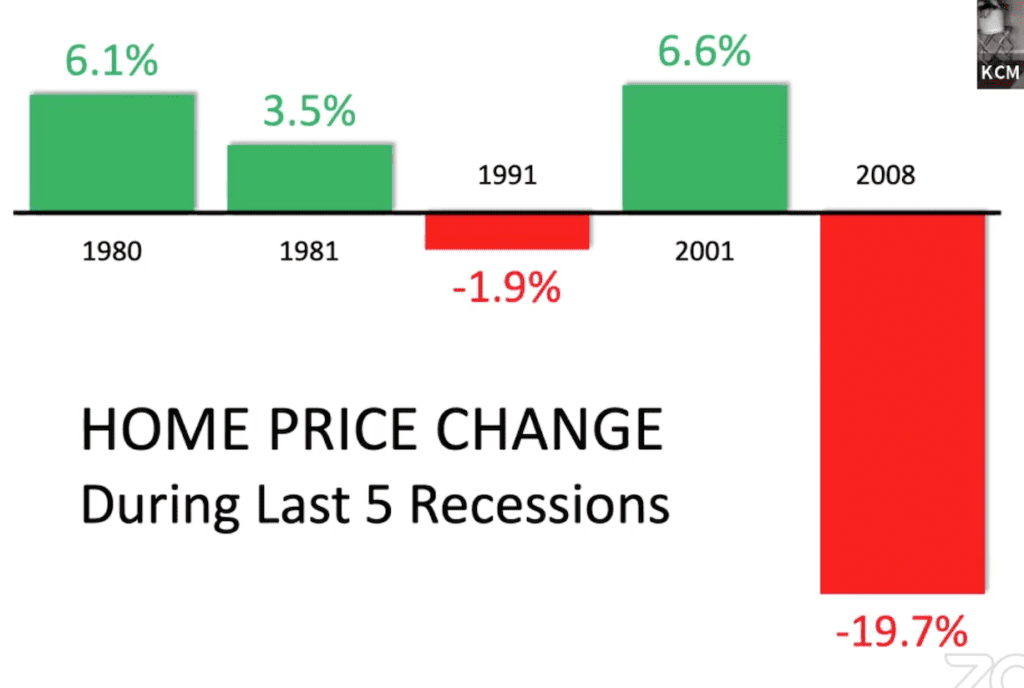

It’s important that we recognize the reasons for that large scale housing price decline was caused by false demand stemming from unethical lending practices. Investors, who were just your average income earner, were buying a large volume of houses with little, if anything, in downpayment. Lenders weren’t requiring income or employment verification. So as soon as the unemployment started to rise, these people had no skin in the game and no income to pay their mortgage fees. This was a recipe for disaster from the very beginning!

Flash forward to 2020, and if you’ve gotten a mortgage in the past 10 years you know this isn’t the case. You practically have to donate a kidney in order to get fully approved by most lenders. Now, lenders call the day before closing for a last check on employment status. There are no sub-prime lending rates available. When purchasing an income producing property (ie not your primary residence) you are required to put a much larger down payment. Times have changed from a lending perspective without question.

However, COVID-19 is something new altogether. There’s no modeling that can predict what will happen for sure, but we can make some educated guesses based on data as it’s rolling in. During the month of March we saw a dip in key leading indicators such as showings, which is a good predictor of future closings. Although March was very strong in closings, the amount of homes under contract has started to decline slightly which is another leading indicator of what’s to come. Supply has been so tight and demand so strong coming into this situation that prices are holding strong, for now.

Here’s what I am certain of as we navigate these uncharted waters, our community and collective energy hasn’t been this cohesive in a long time. I hate to be cliche, but we really are in this together and I feel the spirit of our nation rallying in a way I haven’t seen since 9/11… We are powerful beyond measure. Like you, my heart aches for those, who like myself, have or will see an impact on their income. My heart is breaking for those who have or will experience the wrath of this nasty virus.

I am here because I have a deep desire to serve you, my community. I offer up my real estate knowledge for the most part on this platform, but I also have many other skills and abilities that I’m willing and able to support you with. Here are some other things that I can offer you during this time: a virtual shoulder to cry on, a toilet paper delivery (yes, we scored a whole costco pack this week), social media education, general business and marketing planning, feedback on your ideas or just a friend to listen and tell you how loved and cared for you are.

Stay well my friends!

Lindsay Fricks, Helping you, your family and friends Live & Love in AZ!