Median Home Price

$325,000

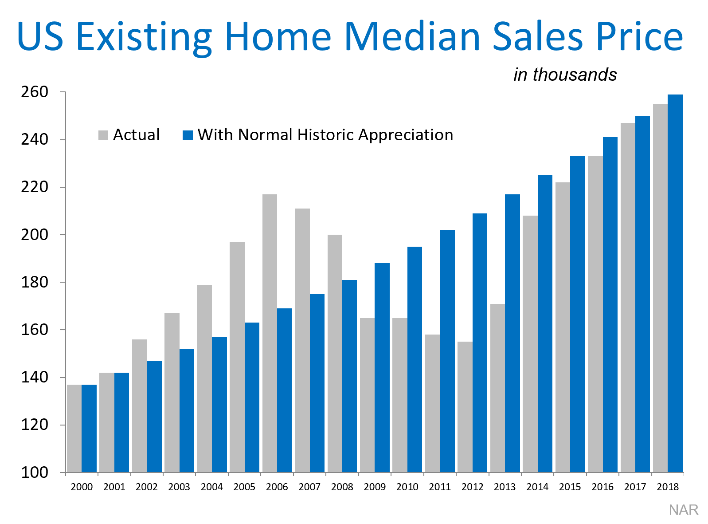

Annual Appreciation Rate

+7%

Estimated Population

450k

Median Age

34

East

Valley

why you want to live here

The two largest and most popular cities in the East Valley are Gilbert and Chandler. Once known for agriculture, the area has now been transformed into some of the most well known suburbs. Both cities have experienced tremendous growth in population and along with it now has all the amenities of larger cities. The suburbs are highly focused around families and have lots of parks, recreation and many family events year-round.